The 16 Money Moves That Changed My Life

Practical strategies that helped me grow my financial wealth - and the freedom to live life on my terms.

Over the past two weeks, we’ve explored Before & After: The Moment Everything Changed, the spark that redefined how I see success, and The Wheel of Life, the framework that keeps it all in balance.

Now it’s time to get practical: the daily decisions, financial habits, and mindset shifts that actually build financial wealth.

Because philosophy is powerful, but philosophy without action doesn’t move the needle.

I’ve spent more than 25 years building my financial net worth through real estate, business, and intentional money management. Along the way, I’ve discovered that the small choices matter just as much as the big ones. Every purchase, every habit, every decision compounds over time.

The goal isn’t money for money’s sake. It’s to build financial strength so you can use that money to enhance the areas of life that matter most: your family, health, growth, and freedom.

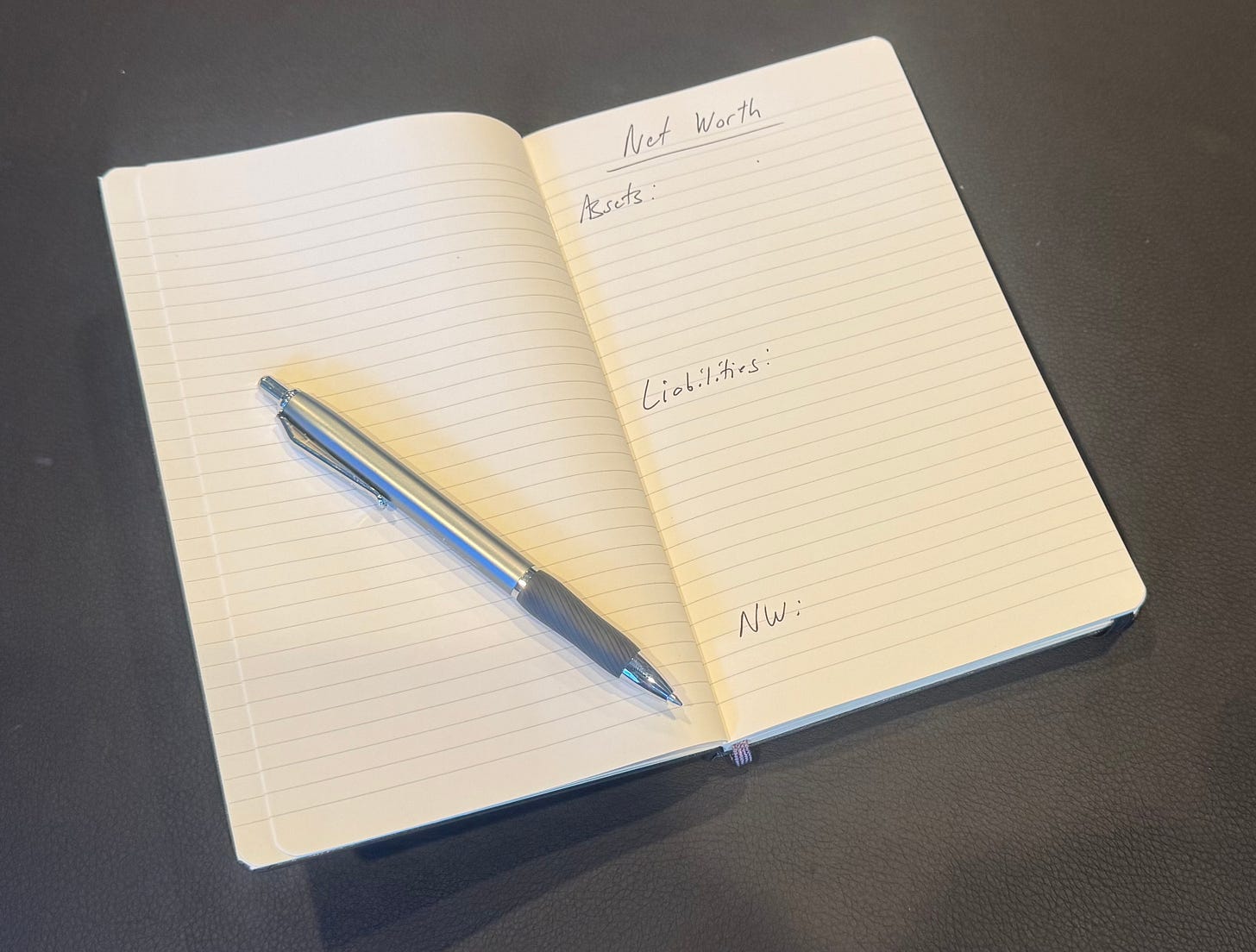

The Notebook That Built My Net Worth

When I was 17, I started tracking my net worth in a notebook. It wasn’t impressive.

I had saved up money from childhood and started investing in the stock market when I was 14. I hit a few early home runs - a blessing and a curse. Those first wins turned hundreds into thousands, which gave me confidence but also made me think investing was easy. By 17, I had a modest net worth in the thousands and college tuition ahead of me.

Still, seeing the numbers gave me something powerful: clarity.

We grew up without much money. At that time, I had one goal in life: I wanted to be rich. I didn’t know exactly how I was going to get there, and I didn’t have a grand plan. What I did have was drive. I knew the best thing I could do was to get good grades, work hard, and earn my way into the best college possible. That was my strategy for changing my financial future.

I didn’t have money, but I had motivation. And that drive gave me grit. Over time, I learned that sustained grit and motivation are real superpowers.

I became a student of money, finance, and investing. One of the first lessons I learned was the power of delayed gratification. A dollar saved and invested today could turn into many more dollars later. And that was exactly what I needed because I wanted to be rich. In the years that followed, every dollar I saved, every loan I paid off, and every investment I made showed visible progress. I could literally see the compounding effect of discipline taking shape.

Without awareness, we drift. We spend reactively, without accountability or any view toward the future. But when you measure something, you manage it. Tracking my net worth became the habit that shaped my financial direction.

Decades later, I still track my net worth twice a year. That simple habit built awareness, and that awareness built wealth. The line has never moved perfectly straight, but it has always moved up - just like the curve of compound growth.

As I’ve made more money, I’ve realized the money itself was never the goal. It’s the fuel, the resource that powers everything else that matters: family, freedom, and fulfillment.

That’s the real goal: not just building financial wealth, but using it to build a meaningful life.

Building Wealth in Layers

Most people think financial wealth comes from one big break: landing the right deal, hitting the right stock, or getting lucky with timing.

But that’s not how real financial wealth is built.

True financial wealth grows in layers:

Habits: what you consistently do with your money

Decisions: the major choices that shape your trajectory

Mindset: how you think about money and use it as a tool

Everyone’s situation is different, and we’re all in different stages of life. But the principle is universal: when you use money to strengthen the other areas of your life, family, health, freedom, and growth, you multiply its power. Being smart with your money allows you to grow it and then use it to build a more meaningful, fulfilling life.

These are the 16 strategies that have made the biggest difference in my own journey. They’re not theories; they’re tested, refined, and real.

16 Strategies for Growing Your Financial Wealth

Track Your Net Worth. What you measure improves. Awareness is the foundation of progress.

Spend Less Than You Earn (Always). The gap between income and spending is your freedom margin. Guard it fiercely.

Automate Good Decisions. Automatic transfers, investments, and savings beat willpower every time.

Invest Early and Often. Time in the market always beats timing the market. Start small and stay consistent.

Buy Assets, Not Liabilities. Cars, clothes, and gadgets depreciate. Assets pay you.

Use Debt Strategically, Not Emotionally. Debt can build wealth when it buys appreciating assets - not when it funds lifestyle inflation.

Prioritize Cash Flow Over Headlines. A steady 8% you control beats a hyped up supposed 20% that you don’t understand.

Be Strategic with Real Estate. I’ve built most of my wealth in real estate, not through flipping, but through buying well, improving intelligently, and selling at the right time. And remember your primary residence is a great place to start building your financial wealth.

Maximize Tax Efficiency. Taxes are your biggest expense. Learn how to legally minimize them through smart structures, depreciation, and timing. Study taxes, ask questions, and learn the rules.

Invest in Yourself First. Courses, coaching, books, and relationships with great people compound faster than any stock.

Protect Your Downside. Insurance, diversification, and healthy reserves let you take bold action without risking it all.

Choose Partners with Integrity. Character compounds just like money. Surround yourself with people who make you better.

Avoid the Comparison Trap. Wealth isn’t a scoreboard, it’s a tool for freedom. Measure progress against your values, not someone else’s highlight reel.

Buy Back Your Time. Spend money to create space for what matters most. Freedom is the ultimate ROI.

Teach Your Kids About Money. Model generosity, discipline, and curiosity. That’s the most valuable inheritance you can give.

Stay Curious and Keep Growing. The best investors, in life and in money, are the ones who never stop learning.

The Bigger Lesson

You won’t implement all 16 overnight, and you don’t need to.

Financial habits are reinforced every single day. Think about it. You make money decisions constantly: what to buy, what to save, what to ignore. Those small choices stack up, quietly compounding over months, years, and decades.

By growing our net worth, it put you in a position to allow your money to work for you, instead of you constantly working more to acquire more money. This shift then allows you to focus on what really matters.

Pick one or two strategies and start small. Layer them in over time. That’s how real wealth is built: not through luck or leaps, but through steady, intentional compounding.

The same way I started: with one simple notebook.

Your Turn

Which of these 16 strategies speaks to you most right now?

Start Bold (Simple First Steps):

Pick one strategy from the list.

Commit to practicing it for 30 days.

Track your progress, no matter how small.

👉 The goal isn’t perfection. It’s progress. Because progress equals happiness, and it’s the surest path to lasting wealth.

Why We Build Wealth

At BOLD Wealth, we believe money is not the goal. It’s a tool.

When you strengthen your financial spoke, it creates the fuel (money) to strengthen every other part of your life: your family, your health, your growth, your ability to give back, and so much more.

That’s the real payoff.

That’s what it means to minor in money and major in life.

A Favor - will you consider clicking the 💚 on this email?

Clicking the little heart icon at the bottom or leaving a comment helps these posts to reach more people (and also makes my day!). If you liked what you read, consider clicking the heart or leaving a comment. Thank you so much in advance!

This is Great

Can’t wait for the first BOOK

Great stuff Chris! Thank you!