He didn’t leave us money. He left us values.

You can discover yours too. Free worksheet inside 📝

The Legacy That Money Can’t Buy

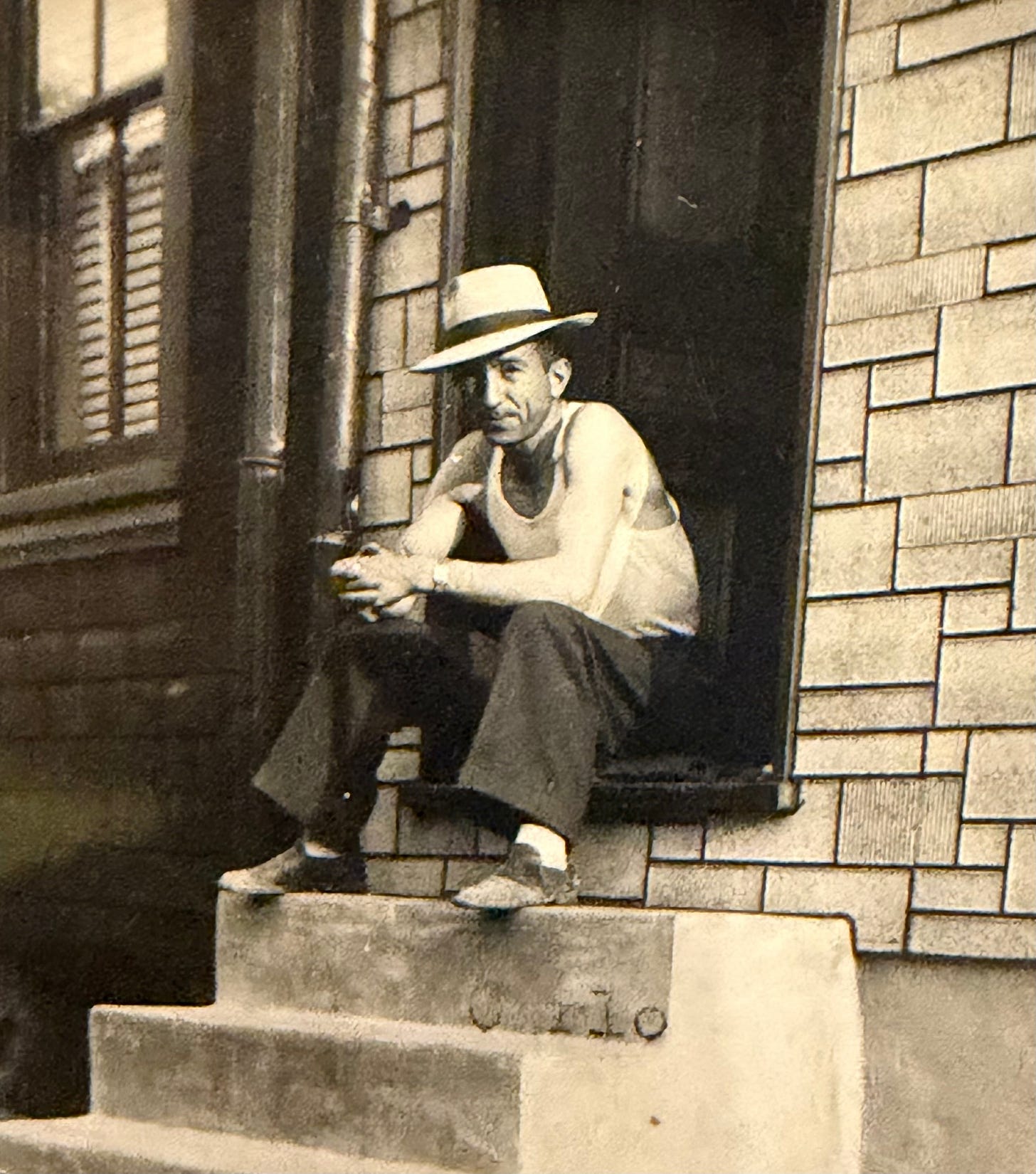

My grandfather on my mom’s side, Carlo, left Italy in 1920 as a teenage boy with nothing but a small bag of clothes and a dream.

His parents sent him alone on a boat to America, hoping he’d find a better life. They put his brother on another ship bound for South America. His brother was never heard from again.

I never met my grandfather. He died the year before I was born. But his courage to leave everything behind changed the trajectory of my entire family.

Carlo worked as a cement mason, saved every penny, and built a life from nothing. He never had much money, but he created something far more valuable: a legacy of hard work, sacrifice, and putting family first. His purpose was simple: to give his children a better life than he had, the same dream his parents carried when they put him on that boat to America.

A century later, I feel that same drive in me, to continue what he started. To build wealth that means something. To pass on more than money.

Because money fades. Values endure.

The Company Playbook

Every company has core values. They hang on walls, show up in handbooks, and guide decisions when no one’s looking. They tell people what’s important, what to protect, and what not to compromise. At work, values are the compass that keeps teams aligned when the map changes.

But most of us never write our own values. We know the company’s core values, yet we couldn’t clearly list our personal ones. We make business decisions guided by mission statements, but make life decisions guided by momentum.

Values are not slogans we tape to a wall. They are the quiet rules that decide how we spend our time, our attention, and our money when no one else is watching. They make hard decisions simpler, not because life becomes easy, but because your choices begin to rhyme. You stop negotiating with yourself. You start recognizing trade-offs faster. You feel the relief that comes from living one story instead of ten competing ones.

Evenings and Invitations

I get invited to a lot of evening events. Some are great, rooms filled with smart people and good energy. Years ago, I said yes by default. Every “opportunity” felt important.

Today, I pause and ask a better question: What am I giving up if I go?

Because saying yes to one thing is always saying no to something else. And remember, time is Your Most Valuable Asset.

Most nights, the real answer is family dinners, homework help, a short walk with Jana, or reading with the boys before bed. My values turn the RSVP into a simple decision. If the cost is time with my highest values, the answer is no. Not because the event is bad, but because my compass points home.

That’s the difference between reacting to life and living by design.

Shared Values, Shared Trust

When our leadership team, my partners, and a few close friends completed the values exercise, something surprising happened. We each circled our top ten from a list of one hundred, then narrowed them to five.

Even though we chose privately, a handful showed up on nearly everyone’s list: Family. Integrity. Growth. Health. Friendship.

A few years ago, when my wife and I each did this exercise separately, the same thing happened. Out of our top five values, at least three were identical. The same overlap appeared with my business partners.

My own list at the time was: Family, Happiness, Leadership, Health, and Friendship.

That’s not coincidence, it’s alignment and influence. We naturally gravitate toward people who share our values, and we also shape each other’s values over time.

That’s why it matters so much who you surround yourself with. Who you spend time with is who you become.

That overlap explained years of trust more clearly than any business retreat ever could. We didn’t agree on everything, but we cared about the same things. Alignment is not an accident, it’s a choice repeated over time.

Culture doesn’t start in conference rooms; it starts in hearts that value the same things.

The Lesson My Dad Taught Without Speaking

My dad’s forty-year fight with MS taught me that values aren’t theories. They’re practical.

When he could no longer leave the house, we turned his bedroom into the place where life still happened. The boys rode bikes around the bed. We brought the noise, the laughter, and the mess to him.

That decision wasn’t efficient, but it was aligned. We were choosing connection over convenience, joy over neatness, presence over productivity.

If you’re ever unsure what your real values are, look for the moments when you happily choose the inconvenient thing. That’s the trailhead.

Money Without Values Feels Restless

Money without values becomes restless. It doesn’t know where to go, so it chases everything: designer clothes, luxury cars, the next shiny thing.

When you’re clear on your values, money calms down. You give it a job.

You use money to create experiences with your family, not just accumulate stuff. You invest in your health, not just your image. You support causes that reflect who you are, not ones that simply look good online.

The numbers stop being a scoreboard and start becoming fuel lines, sending energy to the parts of life that matter most.

The Wheel of Life Connection

If you’ve done the Wheel of Life, you already have a map. Your values are the legend that explains that map. When one area of life feels low, family, health, fun, it’s not failure. It’s feedback. It’s your cue to realign both your calendar and your cash.

You might move an hour from “miscellaneous” to “walk with a friend,” or shift a budget line from “impulse” to “kids’ experiences.” Small changes like these start to redirect your resources toward what truly matters.

When your time and money begin flowing toward your values, everything starts working together. The whole wheel rolls more smoothly.

That’s the relationship between money and values: when your financial decisions reflect what’s most important, they enhance your life. And when money fuels the other areas of your life, those areas grow stronger in return. You’re using money as a tool to build momentum, and once that wheel starts rolling, it’s very hard to stop.

The Values Exercise

Attached is a one-page list of one hundred values. Print it out. Circle your top ten. Sit with it for a day, then cut the list to five.

Do it with your spouse or a friend, but make your first pass alone. Then write your five where you’ll see them every day: your notes app, fridge door, or planner cover.

Next, create one simple rule for each value.

If Family is on your list, your rule might be home by 5:30 and phones down at dinner.

If Health is there, your rule might be movement before meetings.

If Growth is one, your rule might be fifteen minutes of reading before screens.

These rules turn values into decisions, and decisions become actions. Actions repeated consistently form habits, and habits are where compounding begins, in both money and life. Over time, those decisions lived out through daily habits turn your values into the life you build. That’s how your values start Compounding in Money and Life.

And revisit your values yearly. Values evolve as we do. The point isn’t to carve them in stone, it’s to live in awareness.

From Alignment Comes Freedom

There’s a quiet freedom that comes from this kind of clarity. You don’t need to have the same values as everyone else. You only need to live yours on purpose.

When your days agree with your creed, your money finally has somewhere meaningful to go, and your time finally feels like it belongs to you again.

Values turn the chaos of modern life into direction. They give every decision a filter and every dollar a purpose.

So, yes, know your values. Write them down. Revisit them. Use them to shape your hours, your spending, and your attention. Because that’s where true wealth begins.

💡 Your Turn + Start Bold

Download the 100 Values Exercise. Highlight your top twenty. Narrow it to five. Write one simple rule for each and live by them for the next week.

Notice what gets easier. Notice where the friction disappears. That's what alignment feels like.

What’s one way you’ve used money recently that truly reflects your values?

Why We Build Wealth

We build financial wealth not for status or scorekeeping, but to use it as a tool to fuel the areas of life that matter most: family, health, growth, generosity, and joy.

Because true wealth isn’t measured only in dollars, but in the freedom, fulfillment, and connection it creates.

That’s what it means to build BOLD Wealth: a life that’s rich in money and meaning.

A Favor - will you consider clicking the 💚 on this email?

Clicking the little heart icon at the bottom or leaving a comment helps these posts to reach more people (and also makes my day!). If you liked what you read, consider clicking the heart or leaving a comment. Thank you so much in advance!

A powerful story. Thank you for writing this. What a legacy of values! I downloaded the worksheet and loved this exercise. My top 5: Faith, Love, Generosity, Wisdom, Stewardship.

I know Mr Carlo is beyond proud of his lineage and the legacy you all are continuing to build. Thank you for sharing his story and your history.

Going into entrepreneurship, I learned that I would need to be crystal clear on my core values as they would be one the filter through which every decision would need to be made.

Faith - my belief system, my foundation, ultimate purpose and North Star

Family - like you and Mr Carlo they are my strongest external motivating forces

Finance - this is a tool when honored and kept in flow will allow me to become the conduit for multi generational wealth

Friends - relationships are everything and these are the family I get to choose and who choose me over and over again

Fun - if it doesn’t bring me joy (especially on the hard days) I don’t want to do it

Fashion - I’ve learned if I can’t show up with authenticity and fully who I am in the room then I need to change the room, not who I am

Thank you Mr Ehrenfeld. I, like so many others are finding great value in what you are doing and I pray continued blessings, expansion of your vision and prosperity for you and yours, sir!